Navigating Iran's Economic Horizon: A Deep Dive Into Nominal GDP In 2024

Table of Contents:

- Understanding GDP: The Economic Barometer

- Nominal vs. Real GDP: Why the Distinction Matters

- Iran's Economic Landscape: A Precursor to 2024 Nominal GDP

- Projecting Iran's Nominal GDP for 2024: Factors at Play

- The Mechanics of GDP Calculation: Iran's Approach

- Beyond Nominal GDP: A Holistic View of Iran's Economic Health

- Challenges and Opportunities for Iran's Economy in 2024

- The Global Context: Iran's Place in the World Economy

Understanding GDP: The Economic Barometer

At its core, Gross Domestic Product (GDP) serves as the primary gauge of a nation's economic activity. It represents the total market value of all final goods and services produced within a country's borders during a specific period, typically a year or a quarter. Think of it as a comprehensive scorecard for an economy, tallying up everything from the cars manufactured and the food consumed to the healthcare services provided and the software developed. It encapsulates the wealth generated within a nation's geographical confines. It's crucial to understand that GDP is not merely an economic increment; it signifies the total wealth produced in a given year. This total includes components like depreciation, which accounts for the wear and tear on existing capital assets, and consumption, representing the wealth produced and used within the same year. After accounting for depreciation and consumption, the remaining wealth can sometimes be minimal or even negative, highlighting the dynamic nature of economic output. The concept of GDP helps us quantify this output, providing a basis for comparison over time and across different economies.Nominal vs. Real GDP: Why the Distinction Matters

When discussing GDP, it's vital to differentiate between "nominal GDP" and "real GDP." This distinction is not just a technicality; it's fundamental to accurately assessing economic growth and understanding the true purchasing power within an economy. Nominal GDP measures the value of goods and services at current market prices. This means it includes the effects of inflation. For instance, imagine a scenario where a barrel of orange juice sells for $10 today, leading to a nominal GDP of $10,000 for 1,000 barrels. In the past, if the same barrel sold for $1, the nominal GDP for 1,000 barrels would have been $1,000. While the nominal GDP figures are vastly different, the actual quantity of orange juice produced – the real economic output – remains the same at 1,000 barrels. This simple example vividly illustrates that a rise in nominal GDP doesn't necessarily translate into genuine economic expansion; it could merely reflect higher prices due to inflation. Real GDP, on the other hand, adjusts for inflation. It measures the value of goods and services at constant prices, typically by selecting a base year. By removing the distortion caused by price changes, real GDP provides a more accurate picture of the actual volume of goods and services produced, making it the preferred metric for gauging genuine economic growth. When we hear about a country's economic growth rate, like China's 8.1% growth in 2021 (when its GDP reached 114.37 trillion yuan), this growth rate is typically calculated using real GDP, while the absolute value (114.37 trillion yuan) is often presented as nominal GDP. Therefore, when we talk about Iran's nominal GDP in 2024, it's essential to remember that this figure will reflect both the volume of goods and services produced and the prevailing price levels, including the impact of inflation.Iran's Economic Landscape: A Precursor to 2024 Nominal GDP

Iran's economy is characterized by a unique blend of strengths and vulnerabilities, largely shaped by its vast hydrocarbon reserves, geopolitical positioning, and the persistent weight of international sanctions. As we look towards 2024, understanding this complex backdrop is crucial for any analysis of its nominal GDP. Historically, Iran has been a significant player in the global energy market, with oil and gas exports forming the backbone of its economy. This reliance, while providing substantial revenue, also exposes the country to the volatility of global commodity prices. The imposition of various international sanctions, particularly by the United States, has profoundly impacted Iran's ability to sell its oil, access international financial markets, and attract foreign investment. These sanctions have led to significant challenges, including currency depreciation, high inflation rates, and difficulties in procuring essential goods and technologies. Despite these external pressures, Iran possesses a large and diverse economy beyond oil, encompassing significant agricultural, industrial, and service sectors. It boasts a relatively young and educated population, offering a potential demographic dividend. However, structural issues such as state dominance, bureaucratic inefficiencies, and a challenging business environment have historically constrained its full economic potential. The government's efforts to diversify the economy and promote non-oil exports have gained traction, but the pace of reform often faces headwinds from both internal and external factors. The interplay of these domestic characteristics and international dynamics will be central to shaping Iran's nominal GDP in 2024.Projecting Iran's Nominal GDP for 2024: Factors at Play

Forecasting a nation's nominal GDP, especially for a country as complex as Iran, involves analyzing a multitude of interconnected factors. While specific, definitive figures for Iran's nominal GDP in 2024 are projections that can fluctuate based on evolving circumstances, we can identify the key drivers that will undoubtedly shape this critical economic indicator. One of the most significant determinants will be **global oil prices and Iran's oil production capacity and export volumes**. As a major oil producer, fluctuations in crude oil prices directly impact Iran's export revenues, which in turn significantly influence its nominal GDP. Any easing or tightening of sanctions on Iran's oil sector could dramatically alter its ability to sell oil on the international market, thereby impacting its economic output. **Inflation** is another paramount factor. As nominal GDP is calculated at current market prices, a higher rate of inflation will naturally inflate the nominal GDP figure, even if the real economic output remains stagnant or grows minimally. Iran has grappled with persistently high inflation for years, and the trajectory of price increases in 2024 will be a critical component of its nominal GDP. Government monetary and fiscal policies aimed at controlling inflation will play a crucial role here. **International sanctions** remain a pervasive influence. The extent to which sanctions are enforced, modified, or potentially lifted will have profound implications for Iran's foreign trade, access to foreign exchange, and ability to attract much-needed foreign investment. A relaxation of sanctions could unlock significant economic potential, boosting various sectors and contributing to a higher nominal GDP. Conversely, tighter sanctions could severely constrain economic activity. **Domestic economic policies** will also be pivotal. Government spending, investment in infrastructure, support for various industries, and efforts to streamline regulations can stimulate economic activity. The success of diversification efforts away from oil, particularly in sectors like agriculture, manufacturing, and technology, will contribute to a more resilient and sustainable growth in nominal GDP. Finally, **geopolitical stability** both within the region and globally cannot be overlooked. Regional tensions, global trade disputes, and broader international relations can affect investor confidence, supply chains, and the overall business environment, thereby influencing Iran's economic performance and its nominal GDP for 2024.The Mechanics of GDP Calculation: Iran's Approach

While the theoretical framework for calculating GDP is universal, countries often emphasize different methodologies based on data availability and the structure of their economies. Generally, there are three primary approaches to calculating GDP: the expenditure approach, the income approach, and the production (or value-added) approach. In theory, all three methods should yield the same result, as they are simply different ways of accounting for the same economic activity. For instance, in China, prior to the Fourth National Economic Census (Four Econ Census), the production method was predominantly used. Following the Four Econ Census, the income method gained more prominence. This shift highlights that while all methods are valid, practical considerations often dictate which approach a country prioritizes. Iran, like other nations, would employ a combination of these methods, leveraging available data from various sectors to compile its comprehensive GDP figures.The Expenditure Approach (C+I+G+NX)

The expenditure approach sums up all spending on final goods and services within an economy. It's often represented by the formula: **GDP = C + I + G + NX** Where: * **C (Consumption):** Represents household spending on goods and services (e.g., buying food, clothes, going to a restaurant). * **I (Investment):** Includes business spending on capital goods (e.g., factories, machinery), residential construction, and changes in inventories. * **G (Government Spending):** Encompasses government expenditures on goods and services (e.g., infrastructure projects, public sector salaries). * **NX (Net Exports):** Is the value of a country's total exports minus its total imports. For Iran, consumer spending, government expenditure (often substantial due to state-owned enterprises and social programs), and investment in key sectors (like energy infrastructure) would be significant components. Net exports, heavily influenced by oil and gas sales and the impact of sanctions on imports, would also play a critical role.The Income Approach (Labor compensation, depreciation, taxes, operating surplus)

The income approach calculates GDP by summing all the incomes earned from the production of goods and services within the economy. This includes wages, profits, rents, and interest. The formula is typically expressed as: **GDP = Labor Compensation + Fixed Capital Consumption (Depreciation) + Net Production Taxes + Operating Surplus** A key component here is **Fixed Capital Consumption**, commonly known as depreciation. This is the cost of the wear and tear on capital goods (like machinery and buildings) used in the production process. Including depreciation in the income approach is crucial because it represents a portion of the value generated that is set aside to compensate for the reduction in value of capital assets. It ensures that the total value of wealth produced is fully accounted for, including the portion needed to maintain existing productive capacity. For Iran, this would involve accounting for incomes generated across its diverse sectors, from oil and gas to agriculture and manufacturing, along with the depreciation of its industrial and infrastructural assets.The Production Approach (Value Added)

The production approach, also known as the value-added approach, calculates GDP by summing the "value added" at each stage of production across all industries. Value added is the difference between the value of a firm's output and the cost of its intermediate inputs. For example, if a textile manufacturer buys raw fabric for $10 and processes it into a shirt that sells for $25, the value added by the manufacturer is $15. This method avoids double-counting intermediate goods. For Iran, this approach would involve aggregating the value added from its vast oil and gas sector, its manufacturing industries (automobiles, petrochemicals, steel), its agricultural output, and its growing services sector. Given the significant role of state-owned enterprises and large industrial complexes, the production method would be particularly insightful for tracking the output of these key economic pillars.Beyond Nominal GDP: A Holistic View of Iran's Economic Health

While nominal GDP provides a snapshot of a nation's total economic output in monetary terms, relying solely on this figure can be misleading. A truly comprehensive understanding of Iran's economic health, especially for 2024, requires looking at a broader range of indicators that reflect the well-being of its citizens and the sustainability of its growth.Per Capita Income and Disposable Income

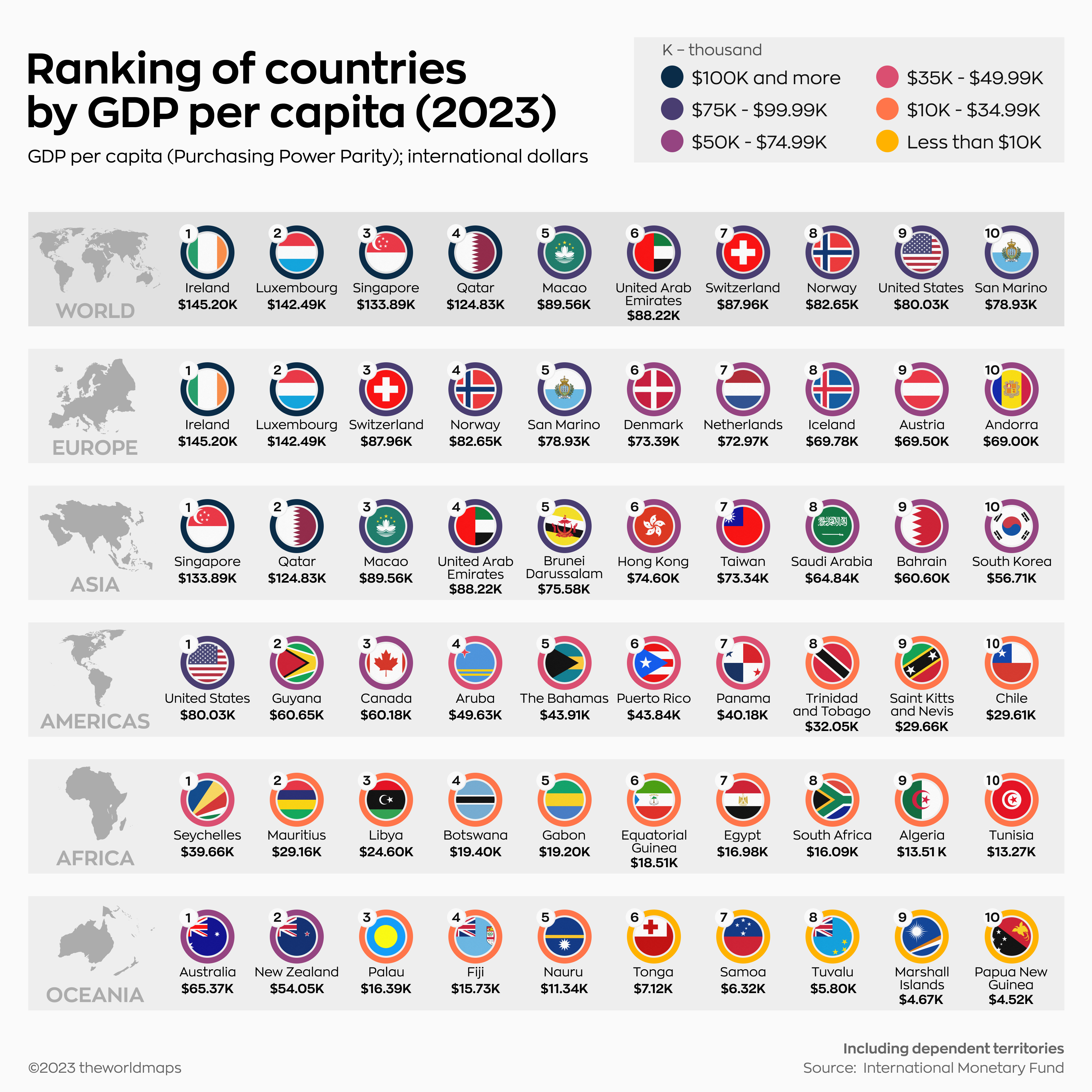

One crucial metric is **Gross National Income (GNI) per capita**, which is equivalent to per capita Gross National Product (GNP) and roughly comparable to per capita GDP. This figure divides the total national income by the average population, giving an indication of the average income per person. While countries like Norway and Qatar boast very high per capita GDPs, largely due to their rich natural resources, this doesn't automatically translate to equitable distribution or high quality of life for all citizens. Similarly, **Disposable Income** refers to the income that households have available for final consumption expenditure and saving. It's the money left after taxes and other deductions, representing what people can actually spend or save. Understanding the trends in disposable income in Iran is critical, as it directly reflects the purchasing power of its citizens and their ability to improve their living standards, which might not always align perfectly with a rising nominal GDP.Wealth Distribution and Quality of Life

The example of Qatar, with its exceptionally high per capita GDP driven by natural gas reserves, yet facing questions about wealth distribution, underscores a vital point. A high GDP does not automatically imply equitable wealth distribution or a high quality of life for all segments of the population. Factors such as income inequality, access to healthcare, education, clean environment, and social services are equally important in assessing a nation's true prosperity. For Iran, analyzing these social indicators alongside its nominal GDP for 2024 will provide a more nuanced picture of its developmental progress and the lived experiences of its people. Other vital indicators include inflation rates (which directly impact real purchasing power), unemployment rates (reflecting job market health), and foreign direct investment (indicating external confidence in the economy). Comprehensive economic databases, which provide granular data on GDP, CPI, imports, exports, FDI, retail sales, and international interest rates, are invaluable for this deeper analysis. For instance, a "China Economic Database" might contain over 300,000 time-series data points, illustrating the depth of information required for a truly informed economic assessment.Challenges and Opportunities for Iran's Economy in 2024

Looking ahead to 2024, Iran's economy faces a complex array of challenges alongside notable opportunities. Navigating these will be crucial in shaping its nominal GDP. **Challenges:** * **Sanctions:** The most pervasive challenge remains the extensive international sanctions, which restrict Iran's access to global markets, banking systems, and advanced technologies. This significantly hampers its ability to realize its full economic potential. * **Inflation:** Persistent high inflation erodes purchasing power, creates economic uncertainty, and complicates economic planning for both businesses and households. * **Water Scarcity:** Iran is an arid country, and increasing water scarcity poses a long-term threat to its agricultural sector and overall economic stability, potentially impacting food security and rural livelihoods. * **Brain Drain:** The emigration of skilled professionals and educated youth represents a loss of human capital, hindering innovation and long-term economic development. * **Geopolitical Tensions:** Regional instability and broader geopolitical conflicts can deter foreign investment, disrupt trade routes, and divert resources towards defense, impacting economic growth. **Opportunities:** * **Regional Trade:** Iran's strategic geographical location offers significant potential for expanding trade ties with neighboring countries and regional blocs, potentially offsetting some of the impacts of Western sanctions. * **Non-Oil Sector Diversification:** Efforts to boost non-oil exports, including petrochemicals, agricultural products, and industrial goods, can reduce the economy's vulnerability to oil price fluctuations and sanctions. * **Potential for Sanctions Relief:** While uncertain, any future diplomatic breakthroughs or shifts in international policy could lead to a partial or full lifting of sanctions, providing a massive impetus to the Iranian economy by facilitating oil exports and foreign investment. * **Young Population:** A large, relatively young, and educated population represents a significant workforce and consumer base, offering a demographic dividend if properly utilized through job creation and skill development. * **Infrastructure Development:** Continued investment in infrastructure projects, particularly in energy, transportation, and digital networks, can enhance productivity and create new economic opportunities.The Global Context: Iran's Place in the World Economy

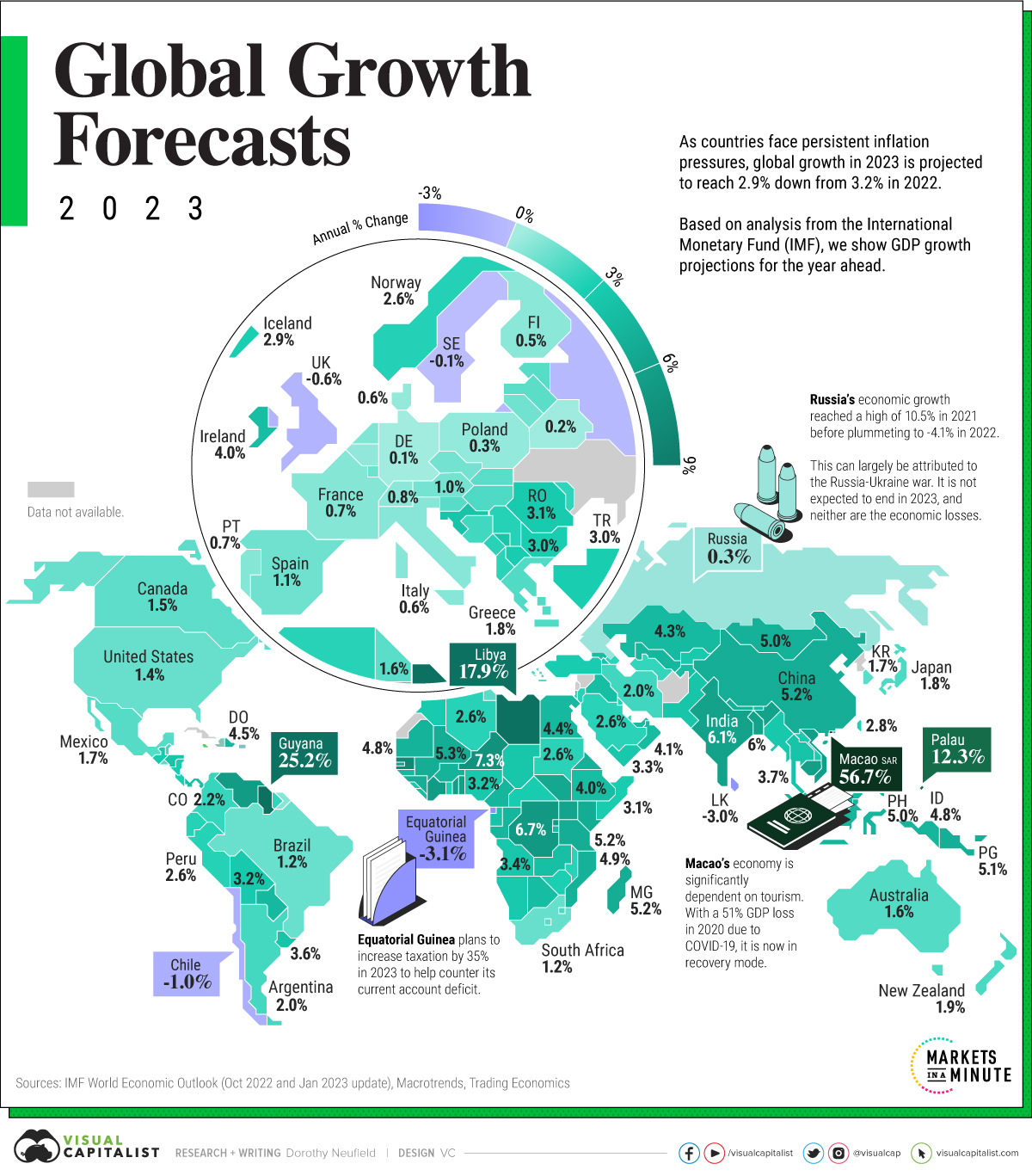

Iran's economic trajectory in 2024 cannot be viewed in isolation; it is inextricably linked to broader global economic trends and geopolitical shifts. Understanding its position within this global context provides valuable perspective on its nominal GDP. Historically, the global economic landscape has seen dramatic shifts. Countries like Germany have maintained relatively stable economic positions, while others, such as the Soviet Union, experienced precipitous declines. Conversely, nations like China and Japan witnessed rapid economic ascensions. China's economic transformation is particularly illustrative; its GDP ranking dropped to its lowest in 1990, falling out of the top ten to 11th place, largely due to the reforms and transitions of the 1980s, before its subsequent meteoric rise. These historical examples highlight how internal reforms, external pressures, and global integration can profoundly reshape a nation's economic standing. For Iran, global oil prices are a direct and immediate link to the world economy. As a major producer, the global supply-demand dynamics and price volatility of crude oil directly impact its export revenues and, consequently, its nominal GDP. Beyond oil, global trade relations, the rise of new economic blocs, and the ongoing shift towards a multipolar world all influence Iran's opportunities for trade, investment, and technological exchange. The country's efforts to forge stronger economic ties with non-Western nations, particularly in Asia, reflect its strategy to navigate the existing international economic order. Furthermore, global technological advancements and the increasing interconnectedness of economies mean that Iran, like any other nation, must adapt to evolving industrial landscapes and digital transformations. Its ability to attract technology, foster innovation, and integrate into global value chains will be crucial for sustainable long-term growth beyond just its nominal GDP. The global context, therefore, presents both constraints and pathways for Iran's economic development in 2024 and beyond.Conclusion

The analysis of Iran's nominal GDP for 2024 reveals a complex interplay of internal economic structures, domestic policies, and powerful external forces, particularly international sanctions and global energy market dynamics. While specific figures for future nominal GDP are projections, the factors discussed—including inflation, oil prices, and geopolitical stability—will undoubtedly be the primary architects of Iran's economic output in the coming year. It's clear that understanding nominal GDP is just the starting point. To truly grasp Iran's economic health, one must consider real GDP, per capita income, wealth distribution, and broader quality-of-life indicators. The challenges are significant, ranging from persistent inflation to the enduring impact of sanctions, but opportunities for diversification and regional economic integration also exist. As Iran navigates these intricate economic waters, its ability to adapt, innovate, and strategically engage with the global community will determine its economic trajectory. The insights gained from examining its nominal GDP in 2024 are not just numbers; they are a narrative of resilience, potential, and the ongoing quest for economic stability and prosperity in a rapidly changing world. We encourage you to share your thoughts and perspectives on Iran's economic outlook in the comments section below. What factors do you believe will have the most significant impact on its nominal GDP in 2024? Your insights contribute to a richer understanding of these complex issues. Feel free to explore other articles on our site for more in-depth analyses of global economic trends and national economies.

Us Gdp Q1 2024 Nominal - Helli Krystal

Gdp 2024 Forecast - Ambur Helaine

2024 Gdp By Country - Vonni Susana